“So happy we found Chuck at Capital Budget Strategies! He spent 4 hours looking over our financials. We now have a game plan for paying off our debt and creating an emergency fund as well as saving for retirement. I definitely recommend Capital Budget Strategies! We feel such a sense of relief since meeting with Chuck and are very grateful to him!

{…}Articles

Make a Financial New Year's Resolution

Why not make a financial New Year’s resolution to finally get your personal finances organized? Ever become stressed about your finances? Ever worry you will not have enough to pay all your bills? Do you have a plan to pay off your credit cards or school loans? Ever worry about saving for retirement? Capital Budget Strategies, LLC, Austin’s best Financial Coach, will help you make 2025 your best year for personal finances. For only $149,

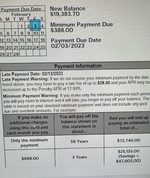

{…}Nasty Truth About Credit Card Repayment

There is a nasty truth about credit card repayment you need to know. Holidays are coming and you are ready to use those credit cards! You are thinking you can repay the debt within a few months. But to be honest, you are still paying off last year’s purchases. Why do people use credit cards? Because they do not have the money to make the purchase. Well, why not save up for it? Of course,

{…}NOVEMBER 2024, JAMES, AUSTIN, TX

“Chuck took the time to look at my financial records to give me a comprehensive plan to get all my ducks in a row! Now that we did a microscopic look at my unorganized finances we can move forward with strong plan to get to my money goals… I was hurting but now I feel a lot better… the plan is easy to understand’ He took his time and listened… I feel this is “diamond

{…}Am I Too Young to Worry About Retirement?

No! You are never too young to worry about retirement! In fact, you should start s retirement savings account (Personal ROTH IRA, 401(k), TSP, 403(b), etc.) with your first paycheck! The more you save early in your career, the younger you can comfortably retire. For only $149, Capital Budget Strategies, LLC, Austin’s best Financial Coach, will review your entire personal financial portfolio and provide an unbiased opinion on how well you are doing. Together, we

{…}AUGUST 2024, THOMAS D., AUSTIN, TX

“Chuck was extremely professional and clear. He was able to frame my financial situation in a digestible and relevant manner. I highly recommend his services to anyone, regardless of their financial situation.

{…}Help! Where Does My Money Go?

Ever wonder where your money goes each month? You have a great job, a decent income, a sweet apartment high off the ground and are dating that cute intern in HR. Your only concern however, is where in the world does your money go each month? Sometimes there is some left over, sometimes it runs out. What can you do? Simply contact the Financial Coach at Capital Budget Strategies, LLC, Austin’s best Financial Coach. He

{…}How to Help Your College-Bound Child Build Credit

How do you help your college-bound child build credit? The Financial Coach at Capital Budget Strategies, LLC, Austin’s best financial coach, has a great idea. Get your student a credit card, with conditions. Sit your student down and explain personal finances. They will be bombarded with credit card applications on day one. Worst part, the credit card companies hire fellow students to promote them. Do not, under any circumstances, let your student sign up for

{…}How Much to Save for Retirement

Many clients wonder how much to save for retirement. That is a tough question, which depends on when you retire and what type of retirement you wish to have. Retirement can last a long time, so the more money you save, the better off you will be. For only $149, Capital Budget Strategies, LLC, Austin’s best Financial Coach, will work one-on-one with you to create a personal, monthly Budget, set up an Emergency and Survival

{…}Christmas in July?

It may not be Christmas in July, but you can start saving for it now! Clients of Capital Budget Strategies, LLC, Austin Best Financial Coach, are taught that certain expenses will occur, therefore why not save for them? For instance, suppose you spent $600 during the 2023 holiday season and expect to spend the same amount this year. If you had opened an account in January and deposited just $50 month, you would have $600

{…}