I didn’t think I could get much for $149. I was expecting a canned group presentation or a quick presentation. Chuck gave us 5 hours of hard analysis, instruction, and left is with a very workable budget. His techniques are sound and easy to implement. I highly recommend his service. He didn’t try to sell is anything additional services, but I won’t hesitate to use him again.

{…}Articles

February 2019 - Matt, Austin

Chuck came by our house and spent 5 hours with us going over our finances and showing us the way to financial freedom. He knows his stuff, having been a financial crimes analyst for the Army, DoD and CIA. He showed us a path to retirement that is already helping. He’s well organized and methodical, and easy to get along with. We’re already looking forward to our follow up meeting with him in 3 months.

{…}Could Your Family's Finances Survive a Shutdown?

Many people really suffered during the last Federal Government shutdown. Could your family survive if you were not paid for a month or two? Suppose your company shut down or you were laid off or you became injured and unable to work? What if your car broke down and needed a new transmission? How would your personal budget survive the stress? Capital Budget Strategies, LLC, Austin’s best Money Coach, recommends everyone build an Emergency Fund

{…}January 2019 - Tammy, Buda

I was feeling beaten down and full of self loathing for the situation I had got myself in. After meeting with Chuck I thought there was some light at the end of the tunnel. Writing everything down and looking at it as a whole gave me a better perspective and was feeling very hopeful when I left. I highly recommend his services.

Can Your Budget Support a Furlough?

Can your budget support your family if you were placed on furlough? Unfortunately, that is what 800,000 Federal Government employees are finding out right now. One way to know you will be financially secure is to have an Emergency Fund (aka a Survival Fund). Capital Budget Strategies, LLC, Austin’s best money coach, teaches our clients how to build an Emergency Fund that will support their families for 5 months. Nondiscretionary (mandatory) expenses include rent, mortgage,

{…}How to Stop Living Paycheck to Paycheck in Austin

Many people in Austin, unfortunately, only survive living paycheck to paycheck. If their pay is disrupted (with a Federal government shutdown, a labor strike or personal injury or sickness), they have serious trouble paying monthly bills. Remember, people from all economic levels live in fear of having their paycheck run out before the end of the month. How to stop this cycle? The choices you have are not going to be easy. They are going

{…}Learning Financial Literacy in Austin

Finding financial education in Austin, or anywhere else, is not easy. That is because financial literacy is not taught in high school, college or even at home. Why? Because people are “afraid” of their finances! They think it is too difficult for them or they are too busy or they are just scared about what they might find out. Sorry Austin, but it is time to be an adult about your money! For only $149

{…}Best Financial Education in Austin in 2019

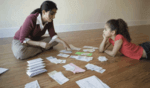

Most people in Austin do not want or need complicated financial advice. Why discuss the intricacies of “intermediate-term corporate bonds” verses “short-term investment grade bonds” when all they want is help making a personal budget and paying off credit card debt. Most people say, “Once I get my basic financial life organized, then I will worry about having the right investments!” What they need is a great Austin Money Coach who will patiently sit down

{…}Building a Family Financial Budget: The First Step to Financial Freedom

When you use a family financial budget, you are taking your first steps to financial freedom. Suppose your boss says, “Congratulations, you are in charge of my retirement party.” What are your questions? 1. Can I get her job? 2. Can I get her office? 3. How much can I spend? You need to know the party’s budget so you do not overspend company money. Same goes for a family budget. Let’s say your family

{…}Best Personal Finance Class in Austin

The best personal finance class in Austin, Texas is given by Capital Budget Strategies, LLC, Austin’s best Money Coach. Give us about four hours and we will change the way you think about, handle and organize your finances. Many people in Austin make a good salary, but just cannot find the time or energy to get financially organized. They get overwhelmed with all the bills, multiple payments, not knowing what money is coming in and

{…}