Personal debt is something you always carry with you. You think about it constantly, you worry about it constantly and you may even be ashamed of it.

Personal debt is something you always carry with you. You think about it constantly, you worry about it constantly and you may even be ashamed of it.

We are not talking about debt due to unexpected medical bills, a natural disaster or other unforeseen events. We are talking about those who simply used their credit cards too much, purchased a house they could not afford or accepted too many loans for school.

Most likely it took some time to accumulate all your debt. Likewise, it will take time to pay it all off. Getting out of debt takes dedication and sacrifice. Are you mentally ready for it? Ready to act like an adult with your finances?

If so, you must first accept 5 Rules:

RULE 1: No feeling sorry for yourself. So you made bad decisions, but who hasn’t? Time to look forward, not back. Understand what you did wrong, learn from it and then move on. Let today be the start of your new financial life! RULE 2: No more debt! Stop spending money that you do not have. Time to start living within your means (i.e. income), by using only cash or a debit card. Cut up all your credit cards, except one. Put that one card in a drawer because you may need it to rent a car or in an emergency. Do not carry it around with you. Don’t cancel your cards, which could hurt your credit score, just cut them up so you won’t be tempted to use them. RULE 3: Getting into debt is easy, getting out is not. Getting out of debt takes time and sacrifice. You must be willing to put all your energy into becoming debt free. Just think of the freedom that awaits you! Once your debt is gone, all that income you spend on school loans and credit cards will be extra money in your pocket. RULE 4: Time to start an Emergency Fund so you do not go back into debt. Because your car might break down, you might get laid off or you might have an unexpected medical expense. Start saving $50 or $100 a month and keep that money easily accessible in a savings account. Build it up to $1,500 to start. RULE 5: All extra money from pay raises, tips, birthday gifts, holiday bonuses, etc. will be put towards paying off your debt. No more fancy dinners or expensive vacations for a while.Ready to start? Here is the 4-Step method we recommend for getting your finances organized and giving you a clear picture of where you stand. Seeing a true picture of your financials is a great motivator!

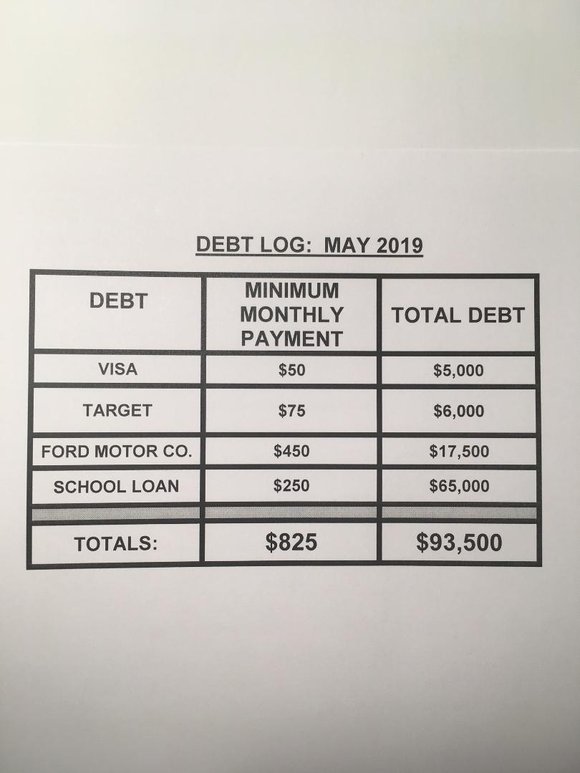

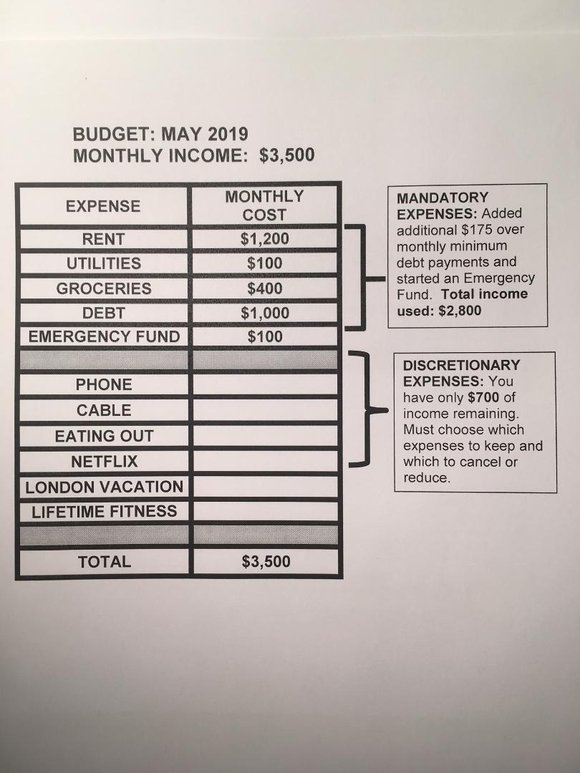

STEP 1: Create a “Debt Log.” On paper, draw a chart with 3 columns. (See photo) COLUMN 1: Write down each debt separately, except your mortgage. Your debts includes anything with monthly payments: credit cards, auto loan, school loan or personal loan. You may use one line here or 25 lines. COLUMN 2: Next to each debt listed, write the minimum monthly payment required. Though we suggest never paying less than the monthly minimum, this exercise will show you exactly where you stand. Add up all the minimum payments and write the total at the bottom of Column 2. COLUMN 3: Write the total amount remaining for each debt. Again, add up this column and write the total dollar amount at the bottom. This is your total debt. Your life will now focus on making this number shrink, not increase! STEP 2: Figure out the total monthly income (“take-home pay”) your family receives. Take home pay is what you actually receive after deductions for retirement, medical insurance, social security, etc. STEP 3: Create a Budget. Take another piece of paper and make 2 columns. Write the date and your monthly income above the chart. (See photo)Your monthly expenses will be divided into “mandatory expenses” and “discretionary expenses.”

COLUMN 1: Title this column as “Expense” and list all your monthly mandatory expenses. These are expenses you have little or no control over, such as housing, groceries, utilities, transportation, real estate taxes, etc.Once all your mandatory expenses are listed, add two more rows. One for “Debts” and one for “Emergency Fund.” Paying your debts and building an Emergency Fund are now mandatory expenses in your budget.

Next, list all your monthly discretionary expenses (costs you can control), such as gym membership, Netflix, Hulu, happy hours, concerts, phone, cable TV, etc. You actually control these expenses because you decided to have them. They are not required like housing and food.

COLUMN 2: List the monthly cost next to each mandatory expense. These costs should not change, except maybe utilities.For the row titled “Debt,” find the total amount listed at the bottom of Column 2 from your Debt Log (see STEP 1, above), then add $50, $100, $150 or whatever number you can manage to this total and write it down. Remember, you need to pay more than the monthly minimum to get out of debt!

For the row titled, “Emergency Fund,” start by adding $50 or $100 per month. The more the better.

Total up all your mandatory expenses. Then subtract this total from your monthly income (take-home pay) listed at the top of the chart. The result is how much money remains to pay all your discretionary expenses.

Next, divide your remaining income among your discretionary expenses. If your expenses are more than your remaining income, you need to cut back on or cancel some discretionary expenses.

Continue to fill out Column 2 until the total for all expenses (mandatory and discretionary) equals your total monthly income. Your expenses must equal your income exactly. Money In = Money Out. Every dollar needs to have a designated place in your budget.

The goal of creating a Budget is to find extra money you can add to your monthly minimum payments for your debts. Remember, you must pay over the monthly minimums to get out of debt!

If you have “extra” income that is not designated anywhere, add it to your “Debt” payment. For instance, if your income is $2,500/month and your total monthly expenses are $2,300, add $200 to your monthly Debt payment to pay it off faster.

QUESTION: What if your monthly income is less than your monthly expenses? Well, you have only two choices:

CHOICE 1: Earn more money (more income) CHOICE 2: Spend less money (less expenses)To earn more, you can find a higher paying job, get a weekend part-time job, drive for Uber, deliver pizza, work an extra shift at work, start a side business, have a garage sale or sell your car and buy a cheaper model. Every extra penny earned goes towards paying off debt!

To spend less, you can find cheaper housing, get a roommate, become a roommate, cut out cable TV, cut back on your phone usage, cancel your gym membership, stop eating out and bring your lunch to work. Get creative, because the faster you get out of debt, the faster you will get your life back!

Need help with our plan? For only $149, our Austin Financial Coach at Captial Budget Strategies, LLC will teach you how to handle your money like an adult! Working together, we will determine your true Net Worth, analyze your spending, set up a Household Monthly Budget, an Emergency Fund and a Snowball Debt Repayment Plan. We will even give you an idea how well you are doing saving for retirement.

Our Austin Financial Coach can meet at your office, your home, our home office or any quiet place that has comfy chairs, coffee and a large table! We can meet you during the day, in the evening and even on weekends.

Give us approximately 4 hours and begin your journey to financial security and winning your retirement.

You can do it. We know you can!!

Question or Comment? Enter it below.