Suppose you need to buy a new car to get to work in downtown Austin, but you also need a loan. Your credit score plays a major role in who might lend you money and how much interest they will charge.

Lenders consider a buyer with a low credit score (under 660) to be a higher risk of not paying back their loan. Therefore, to protect their money, lenders charge these buyers a higher rate of interest. Experian, one of the big three credit-reporting agencies, has reported:

• Credit score under 660: New car interest averaged 9.5%

• Credit score over 661: New car interest rates averaged 4.1%

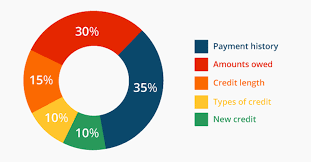

Lenders look at two factors: whether you pay your bills on time and how much total debt you have. Paying on time is a quick way to raise your score. Pay the minimum if you must, but pay on time!

Your total debt compared to total credit available is called the “credit utilization level.” Suppose with all your credit cards your total “available” credit is $10,000. With a $5,000 total balance, your credit utilization level is 50%. That is too high – lenders like 30% or lower.

How to lower your credit utilization level? Easy, pay down your debt and do not take on more. But what if you are limited by your income level? Get a part-time job. Sorry Austin, time to be an adult about your finances.

Target stores in Austin are paying $13/hour to work over the holidays. UPS in Austin is starting new hires at $14 for part-time shifts. Time to sacrifice for a few months, earn extra money and get out of debt. That would be the best holiday gift to yourself ever!

Need more tips or help on getting financially organized? Capital Budget Strategies, LLC, Austin’s best Financial Coach, to the rescue!

For only $149, we determine your Net Worth, analyze your spending, set up a monthly Household Budget, an Emergency Fund, a Snowball Debt Repayment Plan and let you know how well you are doing saving for retirement. Finally, we will review your bank accounts and introduce you to on-line banking and automated payments.

Our Austin Money Coach can meet at your office, your home or at our home-office. We can meet during the day, in the evening and even on weekends.

Give us approximately 4 hours and start your journey to finanical literacy and build your financial confidence!

Question or Comment? Enter it below.