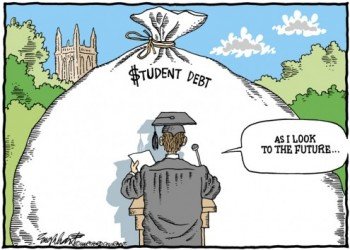

Tracking your student loans can seem impossible. Some graduates accepted separate loans for each semester, which means they now have to track 8 separate loans.

With so much going on right after graduation (new apartment, new job, a new family, new city, new car, etc.), it is very easy to forget paying one or two loans every month.

We have had clients who had no idea how many loans they had, how much they owed, if their loans were consolidated or even if they were government or private loans. Yikes.

Remember, communication with your loan servicer is key. The Federal student loan program can be very sympatric with borrowers, until you stop paying. Once you stop and go into default, Uncle Sam leaves and his mean older brother takes over. He will garnish your wages and capture your federal tax refund.

Do you want your new boss to know that you are not paying your school loans?

It is extremely difficult to discharge federal student loans. In fact, school loans are one of the few debts not discharged by a bankruptcy.

Time to get organized. Introducing the National Student Loan Data System (NSLDS), operated by the U.S. Department of Education. www.nslds.ed.gov According to its website, “if you are a recipient of loans or grants (Title IV Aid) then your record will be viewable in the NSLDS.”

Once you set up a NSLDS account, you can print a personalized chart showing:

1) The number of federal student loans you have

2) If they are consolidated into one loan

3) Who “services” each loan and contact information

4) If they are subsidized or not

5) The interest rate for each separate loan

If you need help sorting your student loans, credit card debt, spending or making a budget, contact Capital Budget Strategies, LLC, Austin’s best Financial Coach.

For only $149 (or $99 for students and recent grads), our Austin Money Coach will determine your true Net Worth, analyze your spending, set up a Household Monthly Budget, an Emergency Fund, a Snowball Debt Repayment Plan and even give you an idea how well you are doing saving for retirement. Finally, we will review your bank accounts and introduce you to on-line banking.

Our Austin Financial Coach can meet at your office, your home or our home-office. We can meet you during the day, in the evening and even on weekends.

Give us approximately 4 hours and begin your journey to financial security.

Question or Comment? Enter it below.