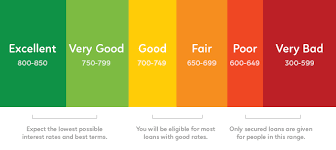

Many of our Austin clients are confused about their credit scores, yet there is nothing mystical about them. Your credit score, which can range from 300 to 850, is simply one indicator of how well you pay back a loan.

Your score is based on your past financial performance and alerts a lender, such as a bank or mortgage company, how risky it might be to lend you money. A low score could cause a bank to deny a loan or charge a higher interest rate.

To achieve a high score, you simply need to pay your bills on time, maintain a few open accounts in your name and keep a low debt-to-credit ratio.

Here are some truths about credit scores:

(1) Will checking my own credit lower my score? No.

There are two types of credit inquiries: hard and soft. Hard inquiries, for instance, occur when you apply for a loan and could potentially lower your score by a few points as it means you are looking for a loan. Checking your own score is a soft inquiry and doesn’t affect your credit report.

(2) Can a potential employer check my credit score? No.

Credit bureaus cannot share your credit score with potential employers. In fact, the Fair Credit Reporting Act requires an employer to first receive your consent before requesting your credit information.

(3) Will losing my job lower my credit score? No.

Losing a job will not affect your credit score. But losing your income could impact your ability to make timely bill payments and missed payments will lower your overall score.

(4) Will a higher income give me a higher score? No.

Anyone can obtain a high credit score simply by making timely bill payments, maintaining a low debt-to-credit ratio and paying off debts.

(5) Will a parking ticket or library fine affect my credit score? No.

Only debts created from a contract or consensual agreement appear on your credit report.

Have more financial questions?

For only $149, Captial Budget Strategies, LLC, Austin’s best Financial Coach, will help you determine your Net Worth, analyze your spending, set up a monthly Household Budget, an Emergency Fund, a Snowball Debt Repayment Plan and let you know how well you are doing saving for retirement. We will even review your bank accounts and introduce you to on-line banking and automated payments.

Our Austin Financial Coach can meet at your office, your home or at our home-office. We can meet during the day, in the evening and even on weekends.

Give us approximately 4 hours and start your journey to finanical literacy and build your financial confidence!

Question or Comment? Enter it below.