Next to buying a house in Austin, a car is probably the most expensive item you will purchase. Yet, we will put more thought into buying a blender than an automobile.

Think about it, if we find a suitable blender for $30, we would not consider another model for $45. Yet, when buying a car, we agree to every upgrade, including the unnecessary undercoating and $200 floor mats.

Unfortunately, at Capital Budget Strategies, LLC, our experience has shown that many people buy cars just to impresses others. We have worked with clients who were deeply in debt, yet drive brand new $60,000 vehicles.

Typically, these clients tell our Austin Money Coach that they “deserve” a nice car. While they may deserve one, the truth is they cannot afford one.

Here are the basics you need to know before visiting a car dealership:

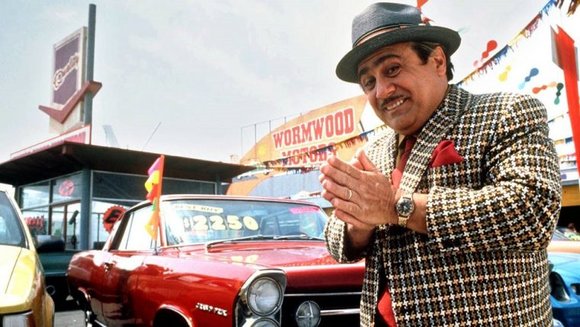

Car salespeople are expert negotiators. They take formal training on speaking to potential buyers and looking for their “weaknesses” to exploit. This may be your first, second or third car buying experience, but your salesperson does this every single day and has gotten very good at it.

Today’s cars are very dependable and will last many years. Therefore, a used car should be your first option. Check out CarMax’s website or their two huge Austin locations for hundreds of vehicles. Plus, CarMax is a “no haggle” dealership (yeah!).

The difference between the listed sales price and what the dealer actually paid is about $2,000. So if you get a $1,000 discount, you will feel smug, however they still made an easy $1,000.

Ask how long a car has been on the lot. Hard to sell cars (unpopular models, unpopular colors, etc.) will receive higher discounts.

Dealers make their money financing car loans. Therefore, never say how much you want to pay a month and don’t be fooled by low monthly payments. They lower monthly rates by extending the term of your loan by additional months or years. Lower monthly payments sound more affordable, but you end up paying thousand more for the car than it is worth. If you ever need to sell the car, you will not be able to pay off your loan with the proceeds.

Rather than deal with monthly payments, discuss your “total cost,” which is how much you actually end up paying over the life of the loan. Paying $50 to $150 extra a month may be painful, but it could save you thousands in the long run.

Here is an example: You purchase a new car for $35,000 and get a loan at 4% interest.

Length of loan: 4 years — 7 years

Monthly payments: $790 – $478

Total cost of car: $37,933 – $40,186

Our Austin Financial Coach suggests finding the extra $320 a month and paying off that car faster and spending less. Plus, you knock off three years of car payments!

Why are dealers happy to give anyone a loan? Because they know if you default, they will just hire someone to retrieve your car in the middle of the night. Remember, when you finance a car, the dealer keeps the car title and it is in the dealer’s name.

Capital Budget Strategies, LLC, Austin’s best Financial Coach, can help you determine how much car you can afford.

For $149, we will also help you organize your finances, create a livable budget, build an Emergency Fund and set up a debt repayment plan.

Give Capital Budget Strategies, LLC approximately four hours of your time and we’ll change the way you think about your finances and buying a car!

Question or Comment? Enter it below.