Ready for some holiday shopping?

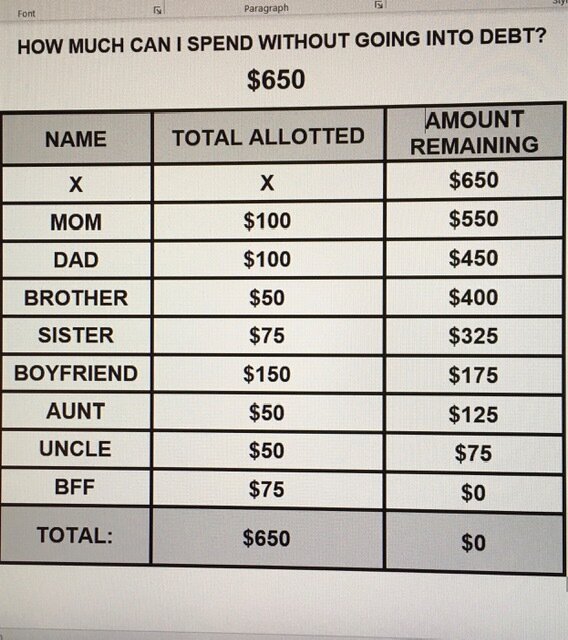

Use this easy 5-step plan to avoid going into credit card debt this holiday season. (Please refer to the attached photo):

STEP 1: Review your financial situation. Come up with a realistic amount you can spend without going into credit card debt.

STEP 2: Draw a chart with 3 columns (See photo)

• Column 1: Title this column, NAME. List every person on your gift list.

• Column 2: Title this column, TOTAL ALLOTTED. Use it to determine how much you can spend on each person.

• Column 3: Title this column AMOUNT REMAINING to keep a running total of how much money remains, so you do not go over budget. In the box directly below the Title, list the amount you can spend.

STEP 3: To give you an estimate of how much you can spend, divide the amount of money you have by the number of people on your list. In the example in our photo, we divided $650 / 8. Therefore, we have $81.25 available per person. You can always spend more or less.

STEP 4: Starting with first person listed, determine how much you want to spend and list that amount in Column 2. Subtract that number from your Total and write that number under Column 3, Amount Remaining. This “running total” makes sure you do not overspend.

STEP 5: STICK TO YOUR LIST. However, if your brother’s gift costs more than $50, you will need to subject an equal amount from another person. It is important you do NOT go over $650.

Extra Credit: Start your 2022 Holiday Gift Shopping savings account on December 26th! Divide the total you spent this holiday by 52 and add that much money per week into your account. You will thank yourself (and me) in December 2022.

For help getting financially organized, building a budget, creating an Emergency Fund or figuring out how to pay off your debts, contact the Financial Coach at Capital Budget Strategies, LLC. It is never too late to start saving!

Question or Comment? Enter it below.