How to Control Your Holiday Spending

Get ready Austin, the holidays are here! Now, here is how to control your holiday spending:

First, and you are not going to like this, do NOT use credit cards! Admit it, if you do not have the cash to buy something, you cannot afford it. Why would you borrow money at 19% just to buy someone a gift they may not like?

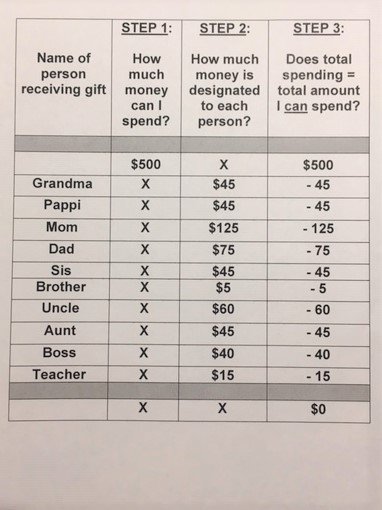

Follow this 3-Step process to ensure you do not go into debt over the holidays. Refer to the attached photo as an example.

STEP 1: Determine how much money you can spend and do not to go over.

STEP 2: Divide the total amount of money you will spend between the number of gifts you have to buy.

STEP 3: Add up the amount you will spend on gifts and verify it either equals or is lower than the amount determined in STEP 1.

Congratulations, you can now enjoy your holidays and NOT go into debt. Even though you are going to get an ugly sweater from Aunt Martha (sorry), this year you can wear it debt free!

If you would like help organizing your finances, contact Captial Budget Strategies, LLC, Austin’s best Financial Coach. For only $149, we will teach you how to handle your money like an adult!

Working together, we determine your true Net Worth, analyze your spending, set up a Household Monthly Budget, an Emergency Fund and a Snowball Debt Repayment Plan. Next, we give you an idea how well you are doing saving for retirement. Finally, we will review your bank accounts and introduce you to on-line banking.

Our Austin Financial Coach can meet at your office, your home, our home-office in Central Austin. We can meet during the day, in the evening and even on weekends.

Give us approximately 4 hours and begin your journey to financial security and winning your retirement.

Question or Comment? Enter it below.