There is a nasty truth about credit card repayment you need to know.

Holidays are coming and you are ready to use those credit cards! You are thinking you can repay the debt within a few months. But to be honest, you are still paying off last year’s purchases.

Why do people use credit cards? Because they do not have the money to make the purchase. Well, why not save up for it? Of course, there are actual emergencies when cards are needed, but gift buying is not an emergency!

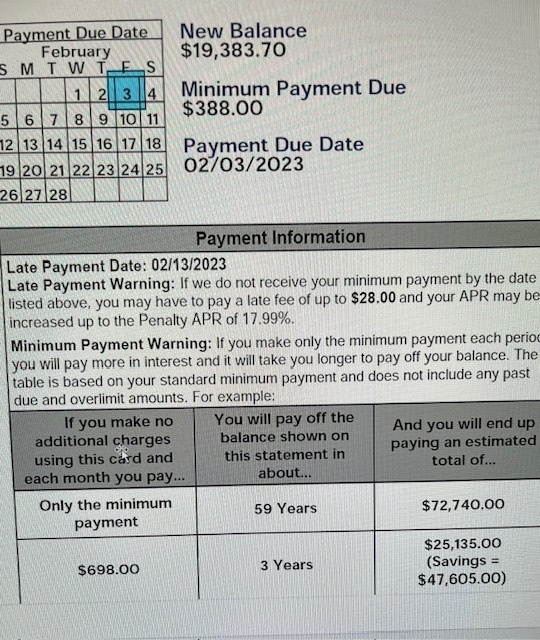

Look at the attached photo of a recent client. He is carrying a debt of $19,383.70. The “minimum payment due” is $388/month. This is the choice the big banks hope you choose. Why? Because it will take him 59 years (yes, 59) to pay it off. Plus, he would have paid a total of $72,740. Unbelievable, right?

But look what happens if he adds just $310 extra a month. He will pay off his debt 56 years (yes, 56) earlier and “only” pay $47,605. Adding even more money pays off the debt sooner.

The reason for the huge difference is the 17.99% interest he is paying.

For only $149, Capital Budget Strategies, LLC, Austin’s best Financial Coach, will meet with you via Zoom Video Conferencing and review your entire financial situation. We will determine your true Net Worth, discuss Emergency and Survival Funds, look at your savings and retirement accounts, and most importantly, create a personalized monthly Budget that will help you pay off your debt and still have a life!

Our sessions usually last about 4 hours and are intense, so be ready! We can meet any day, including weekends. Time to be an adult with your personal finances.

Question or Comment? Enter it below.